The market intelligence platform IntoTheBlock has revealed how Ethereum has built strong demand zones on the chain that should continue above $4,000.

Ethereum has two major support centers just below the current price

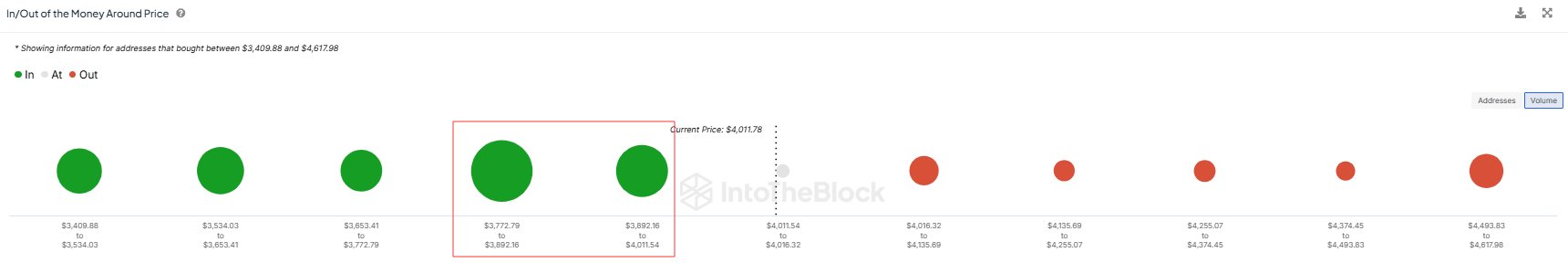

In new mail on X, IntoTheBlock has talked about how the on-chain demand zones for Ethereum look right now. Below is the chart shared by the analytics company that shows how much supply the investors bought at the price ranges close to the current ETH spot value.

As can be seen in the graph, there are only small dots associated with them in the Ethereum price ranges ahead of them, meaning that not much of the supply was bought at these last levels.

It's different for the price ranges below, however, with the $3,772 to $3,892 and $3,892 to $4,011 ranges especially hosting the cost base of a large number of addresses. In total, the investors bought 7.2 million ETH (worth almost $28.4 billion at the current exchange rate) at these levels.

Related Reading

Zones of significant demand are considered to exist chain analysis because of how investor psychology tends to work out. For any guardian, their cost base significant level, so they may be more likely to move when she is retested.

When this retest occurs from above (that is, the investor was previously in profit), the holder might decide to buy more, thinking that the level of profitability would be a- again soon. Similarly, investors who were in losses right before the retest may fear another downturn, so they may sell at their opportunity.

Naturally, these effects do not matter to the market when only a few investors participate in buying and selling, but noticeable fluctuations can appear when a large number of owners are involved.

The aforementioned price ranges satisfy this condition, so it is possible that Ethereum would reconfirm them with a large buying response in the market, which would eventually support the digital currency.

In the past day, Ethereum has seen a small drop into this region, so it remains to be seen whether the high demand can push the coin back above $4,000 or not.

Related Reading

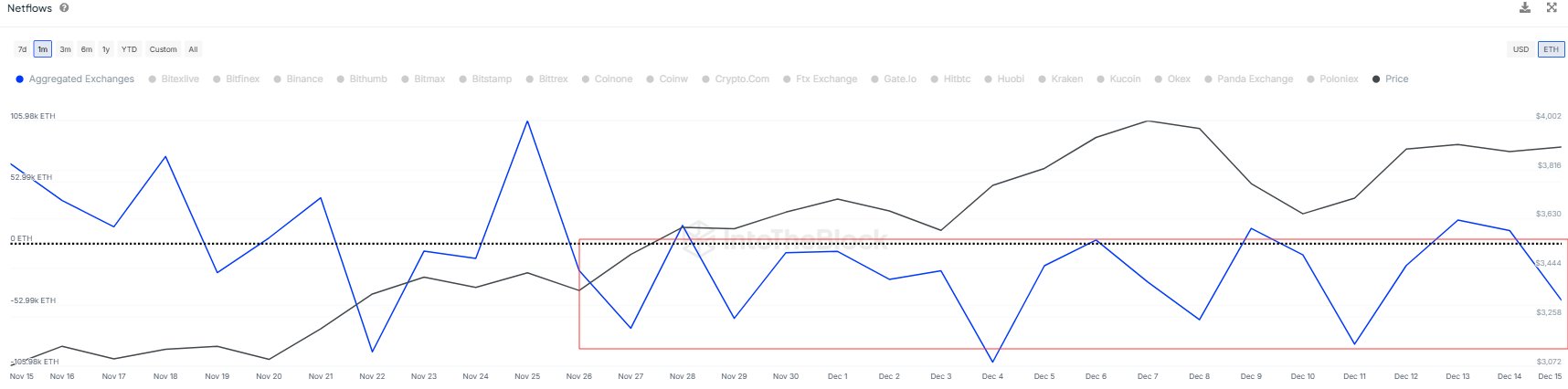

In some other news, the Ethereum Netflow Exchange has been negative since the beginning of this month, as IntoTheBlock has pointed out in another X mail.

The Exchange Netflow is an on-chain token that keeps track of the net amount of Ethereum that flows into or out of the wallets associated with centralized exchanges. “More than 400k ETH have flowed out since December 1st, suggesting a rallying trend,” the analyst firm said.

The price of ETH

At the time of writing, Ethereum is trading around $3,950, up 10% over the past week.

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com