On-chain data shows that a large amount of the USDT stable has been moving to exchanges recently, which could be fuel for the Bitcoin and cryptocurrency rally more broadly.

USDT exchange flows have remained high recently

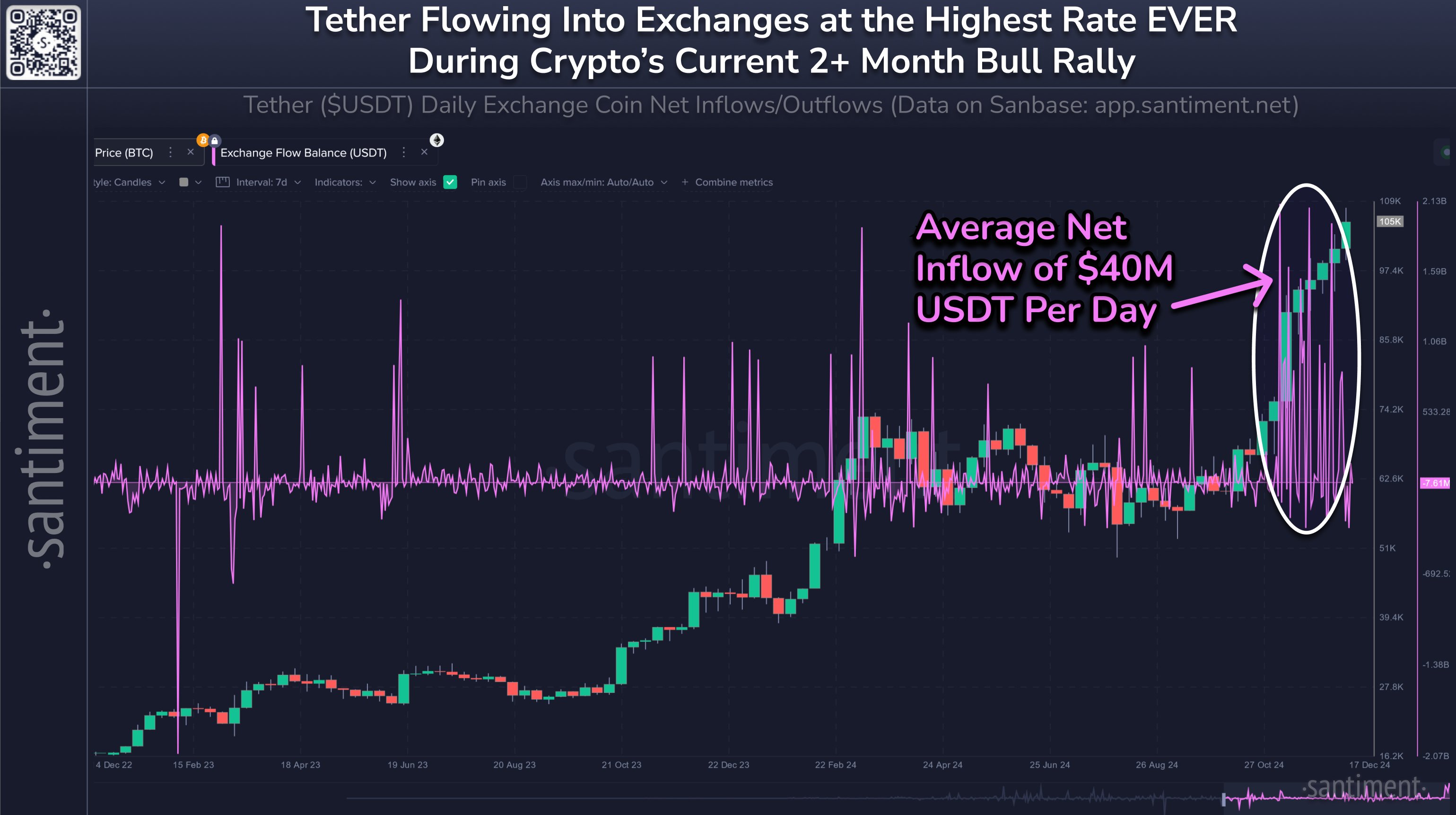

In new mail on X, the analytics company on the Santiment chain discussed the trend in the Exchange Flow Balance for USDT Tether. The “Balance of exchange flow” here refers to a token that keeps track of the net amount of funds brought in or out of the wallets associated with centralized exchanges.

When the value of this metric is positive, it means that the inflows are higher than the outflow, and a net amount of the coin will be deposited into the wallets of the exchangers. Such a move is usually a sign of demand among investors to trade away the digital currency.

On the other hand, the negative signal means that the holders are drawing a net number of signals from these platforms. This type of movement indicates that the market is in a phase of accumulation.

Now, here is a chart that shows the movement in the Exchange Flow Balance for USDT over the past two years:

As shown in the graph above, the Exchange Flow Balance for USDT has seen several large positive spikes over the past month, meaning that large investors have been investing in the token they have

For an asset like Bitcoin, a positive exchange flow balance can be a bearish sign, because it could suggest that the keepers intend to sell it. However, the same is not true when the asset involved is stable.

Investors usually store their capital in these fiat-linked tokens to avoid the volatility of Bitcoin and other cryptocurrencies. Such users will eventually plan to enter the volatile side once they feel the conditions are right.

And when the time comes, they will naturally move to exchanges to convert to Bitcoin or whatever coin you want. This act of selling USDT does not affect its value because the coin, by definition, is always stable around the $1 mark.

On the other hand, the asset they are moving is going to see changes from the purchase. Therefore, stablecoin exchange inflows are usually considered a bullish sign for Bitcoin and other assets.

In the past eight weeks, exchanges have received a net average of $40 million USDT. “Helping to fuel this bull rally and the many historic crypto pumps, look for stable 'dry powder' to continue to flow in through this last stretch of 2024 ,” explained the analyst firm.

The price of Bitcoin

Bitcoin set new full-time senior (FST) passed the $108,000 mark yesterday, but the coin seems to have pulled back since then, as its price is now trading around $104,500.