An analyst has explained how a crossover between these two Bitcoin metrics would have to happen before the 'fun' for the asset begins.

Bitcoin price has yet to cross the 200-week MA

In new mail on X, analyst James Van Straten has discussed the reasonable price and 200-week moving average (MA) for Bitcoin. The “Price realized” here referring to an on-chain token that, in short, tracks the cost base or acquisition price of the average investor on the BTC network.

When the spot price of the digital currency is higher than this metric, it means that the holders as a whole are in a state of unprofitable net profit. On the other hand, it is below the mark suggesting that the overall market is holding a loss.

The 200-week MA, the other interesting metric here, is an indicator from technical analysis. MA is a tool that measures the average value of a specific quantity over a specific period of time and as the name implies, moves over time.

MAs are useful for analyzing long-term trends, as they remove all short-term correlations from an asset's price chart. Certain MAs are considered more important than the other, with one such period being 200 weeks.

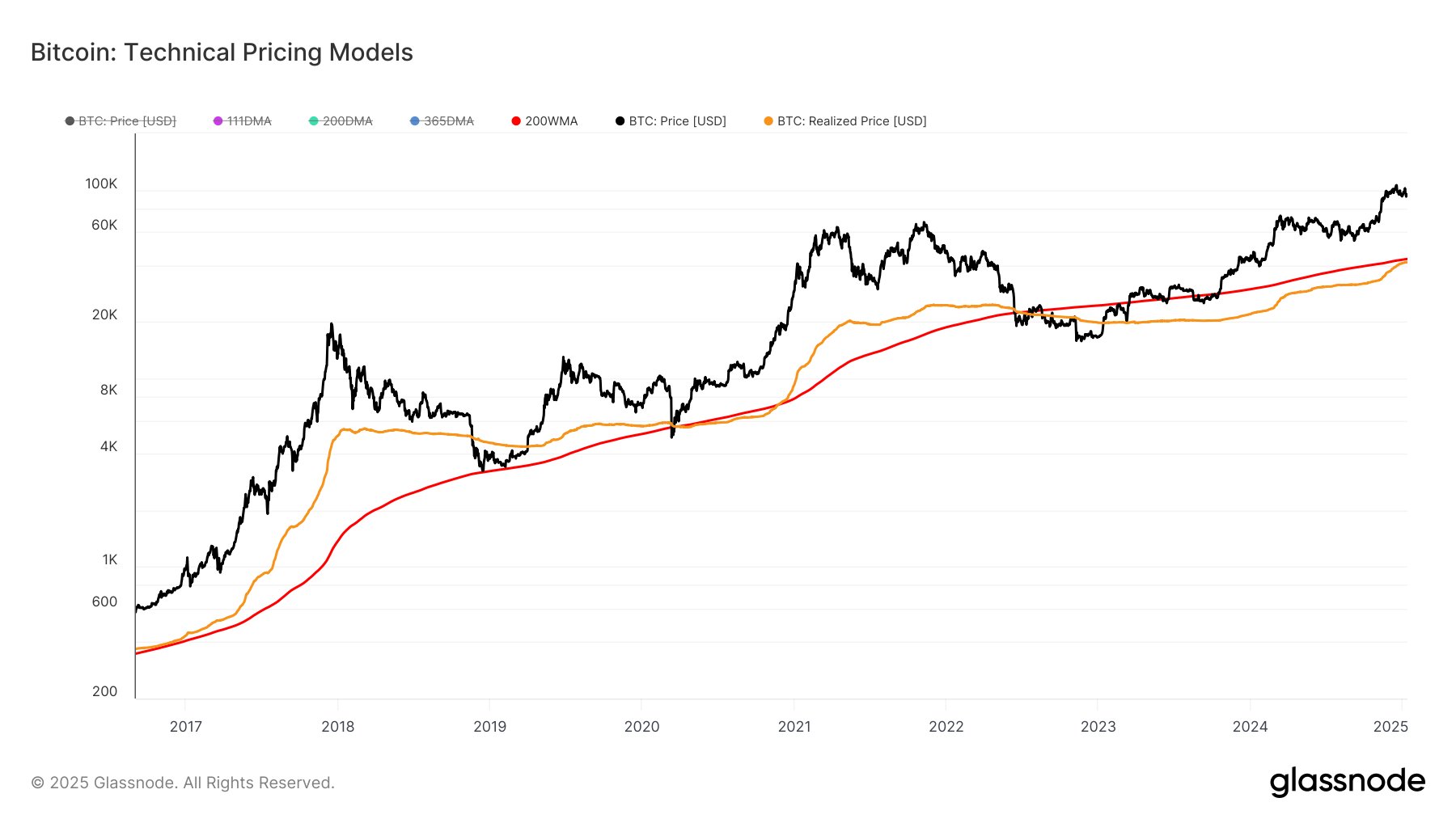

Below is the chart shared by the analyst that shows the movement in the Realized Bitcoin Price and 200-week MA over the past several years.

As shown in the graph, the real price of Bitcoin fell below the 200-week MA back in the bear market of 2022. Since then, the metric has remained below the line, but recently, it has been rapidly approach re-examination.

From the chart, it is evident that previous crosses for the signal above the MA led to a full bull run for the cryptocurrency. “When the realized price turns the 200WMA the fun begins,” said Van Straten.

Therefore, it is possible that such a crossover could be bullish for Bitcoin in the current cycle as well. It is yet to be seen, however, whether the total price would exceed the level in the near future or whether a rejection is pending.

On another note, historically the True Price has been the boundary line for the bear market decrease in the price of the asset. As mentioned earlier, most of the market goes into a losing state when BTC falls below the metric. There are not many sellers left looking to take profits in such a market, which is why the asset tends to bottom out during that time.

BTC price

Bitcoin has shown a sharp jump over the past day as its price has recovered to the $96,600 mark after falling as low as below $90,000 yesterday.