Data shows that the cryptocurrency derivatives sector has seen a lot of liquidation in the past day as Bitcoin and others have enjoyed a rally.

Both long and short Crypto liquid has been high today

According to data from CoinGlassA lot of liquidity has accumulated on the derivatives side of the digital currency sector following market volatility.

“Demolition” here refers to the strong closing of any open contract after accumulating losses to a certain extent (the exact percentage of which may differ between platforms).

Below is a table that shows the data for the liquidations that have occurred in the digital currency sector in the last 24 hours.

As can be seen, liquidation has reached nearly $306 million in this window. Of this, $154 million were long positions, and $151 million were short positions.

This incredible split even suggests that no side of the market has been affected more than the other, which is interesting given the context that Bitcoin and other coins have seen their prices. get up during the past day.

It would seem that the traders have been committed to setting up a supportive position with a lot of leverage attached in this recovery rally, which leads to any pullback on the way up catching them and adding to the long liquid counter.

In terms of how much the derivatives flow with the individual symbols, Bitcoin has once again come out on top with just under $98 million in liquidation.

Ethereum (ETH) and XRP (XRP) rounded out the top three with $37 million and $25 million in liquidation, respectively. This top three appears to be the top three medals in the market cap a list.

Number four in liquidation does not correspond to market cap level, however, as XRP has been followed by Dogecoin (DOGE) with nearly $16 million in contracts. The high contribution to the pressure by the memecoin could be due to its popularity which means that specialists are directed to it more than bigger altcoins like Solana (SOL).

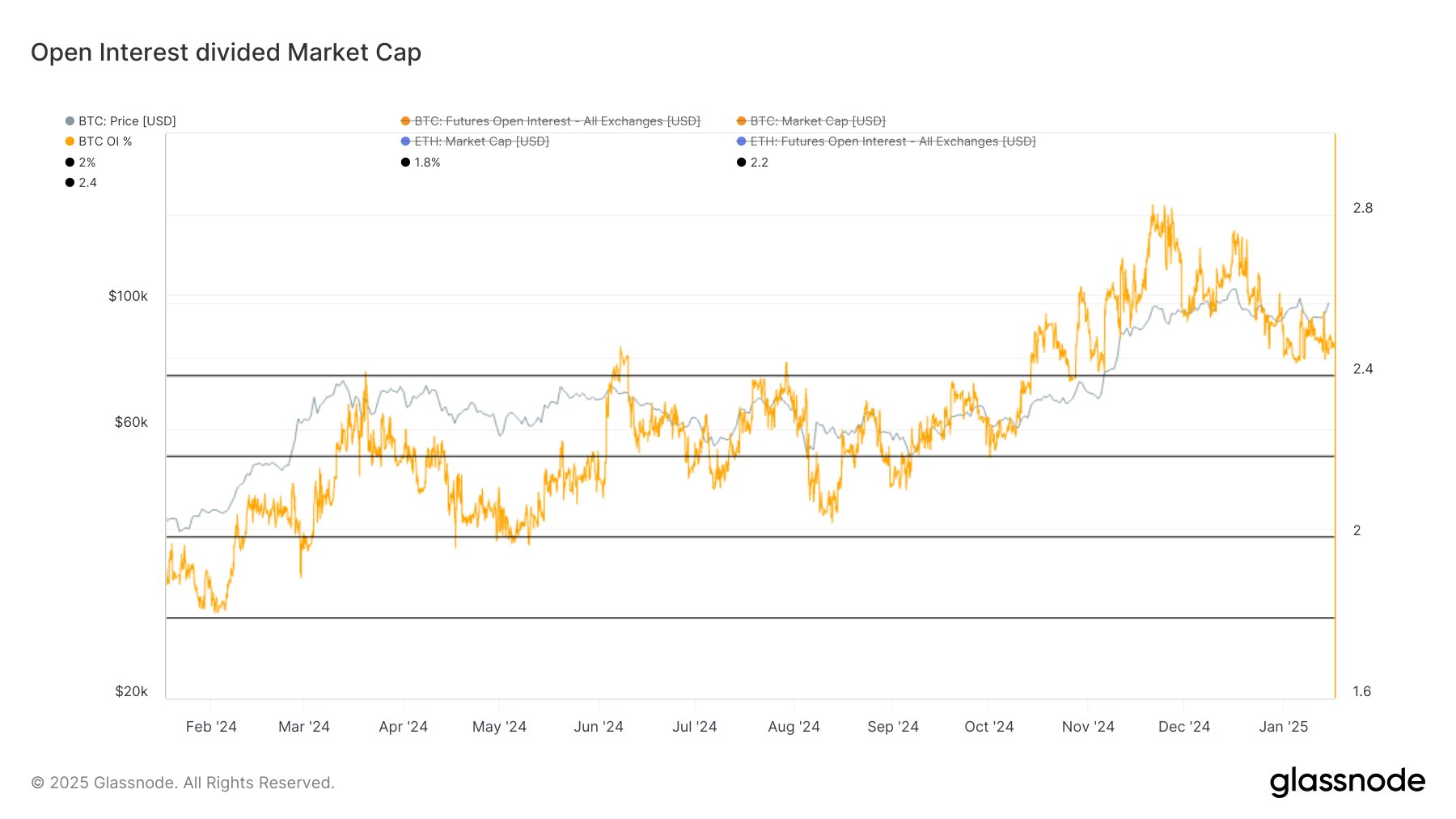

In some other news, the Bitcoin open interest has decreased compared to the market cap recently, as the analyst James Van Straten has pointed out in X. mail.

The “Open Interest” refers to a measure of the total amount of Bitcoin-related derivatives positions currently open on all centralized exchanges. A high level of speculative activity usually leads to volatility for the asset, so the ratio of this metric to market cap should remain low.

From the graph, it is evident that the ratio shot up to a high of 2.8% in November, but its value has since cleared to around 2.4%, a healthier level.

The price of Bitcoin

Bitcoin's latest rally has continued in the past day as its price has reached $104,000.