On-chain analytics firm Santiment has revealed that Dogecoin and XRP are flashing bullish signals in an often-overlooked metric.

Dogecoin, XRP, & Bitcoin have recently declined in the age of the average dollar investment

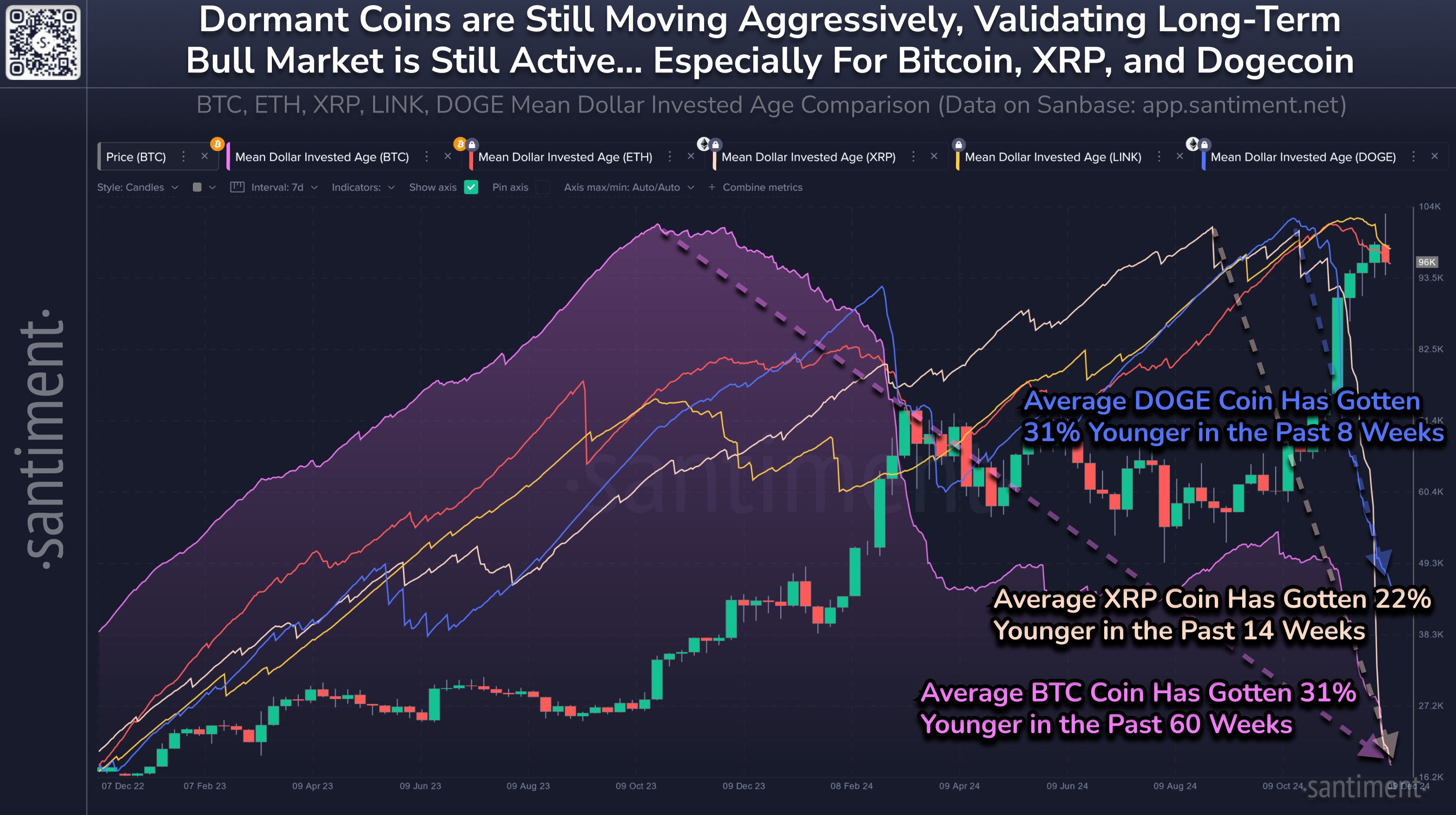

In new post on X, Santiment has discussed the latest trend in the Dollar Investment Average Age indicator for a few of the top coins in the digital currency sector.

The “Mean Dollar Invested Age” tracks the average age of each dollar that the owners have invested into the digital currency. This metric is similar to the Median Age of Coins, an indicator that measures the average age of tokens in the entire distribution supply.

The Middle Ages use dogs chain data to find out when all coins were last transferred on the network and calculate the average for the supply based on it. The Average Dollar Deposited Age works on the same data, except that it converts the coins to their USD value based on the price of their last move.

Now, here is a chart that shows the trend in the Middle Ages dollars invested for five major digital assets: Bitcoin (BTC), XRP (XRP), Dogecoin (DOGE), Ethereum (ETH), and Chainlink (LINK).

As shown in the graph above, the Average Investment Dollar Age has recorded declines for all five of these cryptocurrencies recently, but the scale of the drawdown has been relatively small in the case of Ethereum and Chainlink.

On the other hand, Bitcoin, XRP, and Dogecoin have seen a significant decrease in the token. As for what it means when this metric is trending down, Santiment explains:

When a network's Investment Dollar Median Age line is moving downward, it indicates that older, stagnant wallets (especially from large key stakeholders) are circulating their old coins back into circulation, increasing network activity. .

Although this suggests that the older hands that could be involved in sales, another way of looking at it could be new capital flows into the market, buys these idle coins and brings the average age down.

In fact, it seems that historically, the pattern has been positive, as the analyst firm said:

This is one of the key indicators in each coin's life history that helps prove that a bull market can and should continue. Similarly the bull markets of 2017 and 2021 did not come to a halt until the average asset age started to “up” (get older) again.

Of the three assets that have seen sharp declines in the Middle Age Dollar Investment, Dogecoin has stood out in particular for both the scale and speed of the drawdown; The average dollar invested into the memecoin has grown by 31% over the past eight weeks.

DOGE price

At the time of writing, Dogecoin is floating around $0.403, down nearly 2% in the past seven days.

Source link