The chain analysis company Glassnode has revealed the level that Bitcoin would have to rise if it has to reach the highest historical area in this price model.

Bitcoin has not crossed the last MVRV price band yet

In new post on X, Glassnode has talked about the extreme euphoria threshold of the Bitcoin Market Value to Real Value (MVRV) Price Band. The MVRV Price Bands is a pricing model for the cryptocurrency based on the MVRV Ratio.

Related Reading

The “MVRV ratio” is a popular on-chain indicator that keeps track of how the value of Bitcoin investors (that is, market cap) compares to the value they originally invested (the cap understood). When the metric is greater than 1, investors have more value than their original investment, meaning they are in a state of net profit. On the other hand, it is below the threshold indicating that the market as a whole is under water.

Historically, the owners being in excess of profit has often been indicative of an overheated situation for Bitcoin, as selling with a profit motive is likely to be popular in such situations. Likewise, loss leadership has led to a bottom, as there are not many sellers left at these times.

The MVRV Price Band aims to capture this relationship. It defines specific price levels for the cryptocurrency that correspond to important levels in the MVRV Ratio.

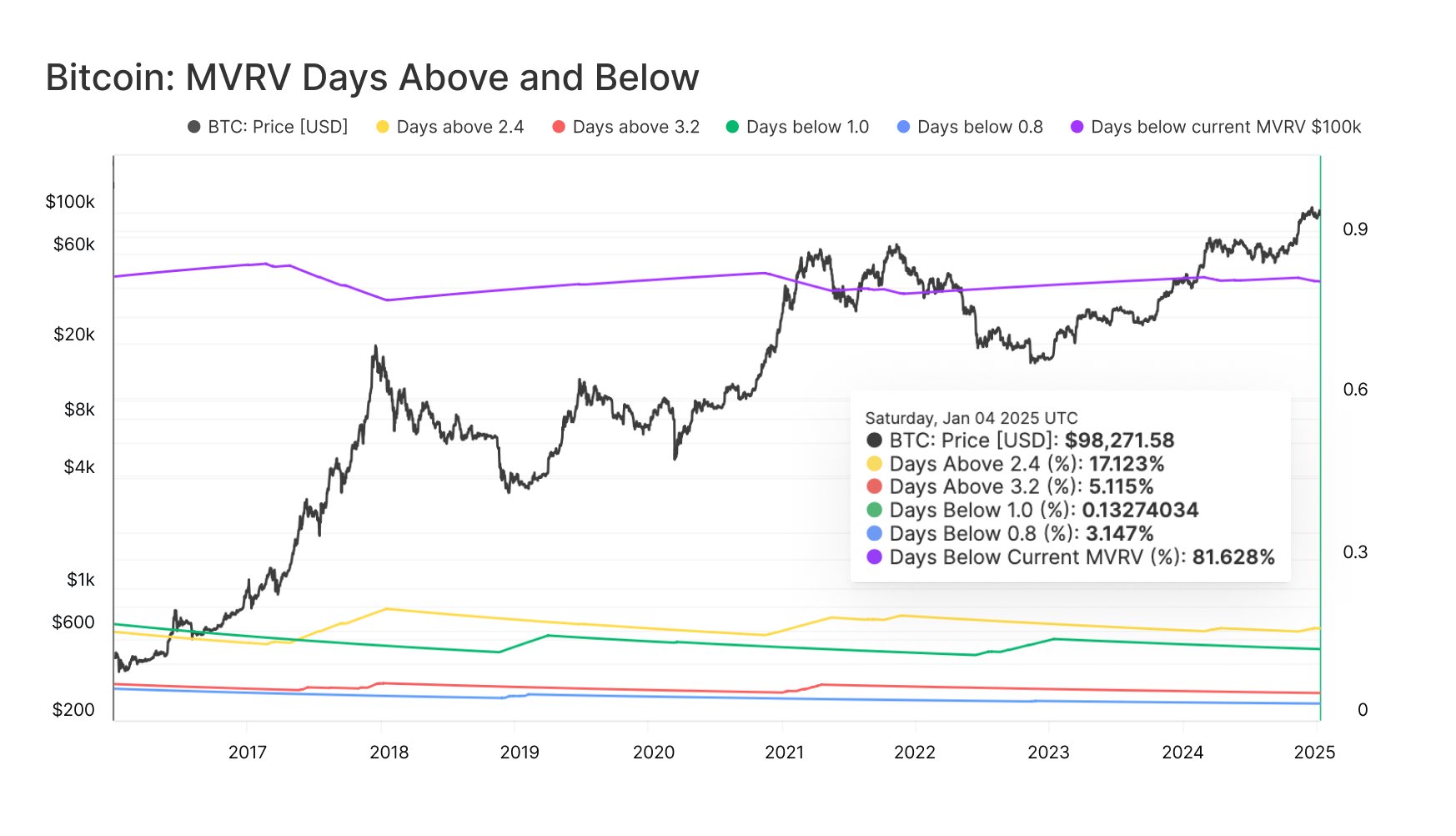

Here is the chart for the model shared by Glassnode that shows the movement in these Bitcoin price bands over the last several years:

From the graph, it can be seen that the price band 0.8, that is where the MVRV Ratio assumes a value equal to 0.8, has been around where bear market a foundation is created for the fund. Currently, BTC is well above this level, located at $33,100. The price of the coin is also at a great distance from the 1.0 level of $41,300, which corresponds to the cost base of the average address or investor on the network.

The price bands that BTC is currently trading under are the 2.4 and 3.2 levels, set at $99,300 and $132,400, respectively. The first of these has historically been a sign that the bull market is heating up.

Related Reading

BTC can stay within this zone for a while, but once the market cap crosses the 3.2 level, it will be very likely that some kind of ceiling will be hit soon.

The table below shows how rare it is for the fund to trade in the sector above 3.2:

“Historically BTC price spent only ~5% of trading days above the 3.2 MVV level,” notes the analyst firm. “This shows how rare these peaks are and underlines why it is often considered the realm of “true euphoria”.

Until now, Bitcoin could not cross this line in the current cycle. If the bull markets of the past are anything to go by, the top would only occur above this level, which would mean that there would still be more room left for the fund run in the current cycle. It remains to be seen, however, whether the pattern would actually hold this time or not.

BTC price

At the time of writing, Bitcoin is trading at around $93,400, down more than 3% over the past seven days.

Featured image from Dall-E, Glassnode.com, chart from TradingView.com