Data on chain shows that Bitcoin miners have been selling for about a year now. Here's what they've sold so far.

Bitcoin miners have lost over 4% of their holdings in the past year

As noted by CryptoQuant community analyst Maartunn in a new one mail on X, the BTC miners have been in net selling mode for a long time. The on-chain relevance metric here is the “miner's reserve,” which tracks the total number of coins that all miners currently carry in their wallets.

Related Reading

When the value of this token increases, it means that chain validators are adding a net number of tokens to their combined holdings. Such a movement can be a sign that this group gatheringwhich can be naturally bullish for the price of the asset.

On the other hand, the metric looking down indicates that the miners are withdrawing coins from their addresses. The main reason is that this group makes such transactions for reasons related to sales, so this type of movement can have a bearish effect on BTC.

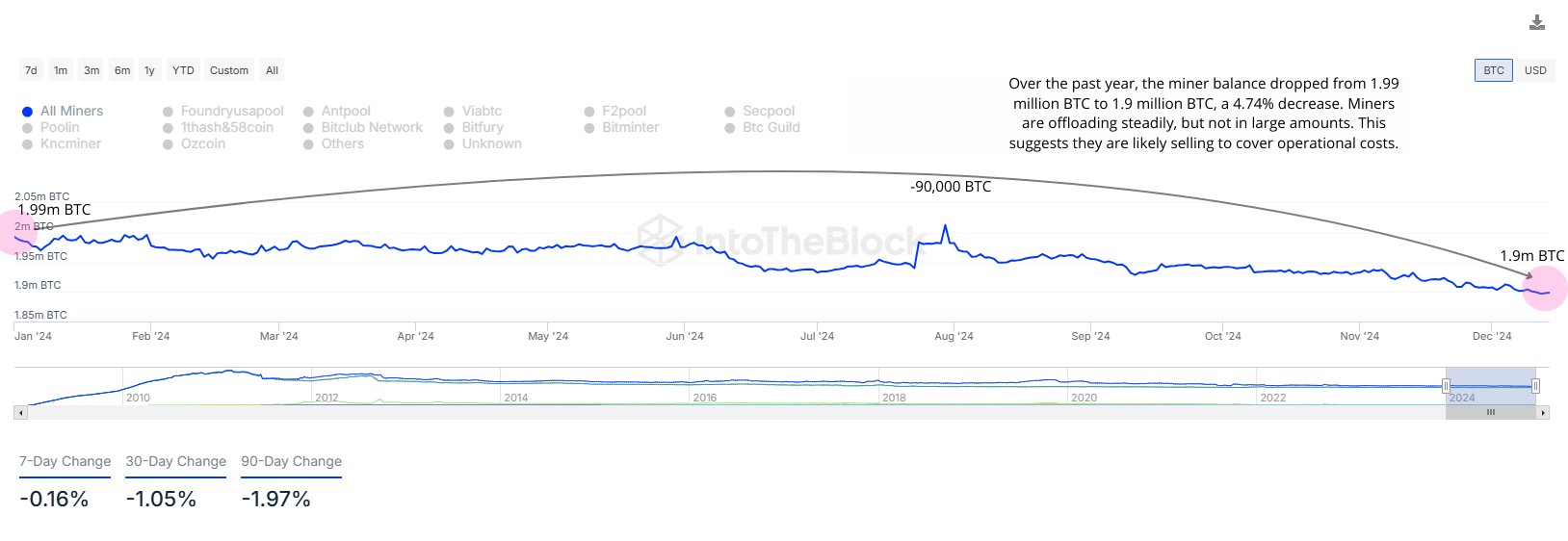

Now, here's a chart that shows the trend in Bitcoin miners' reserves over the past year:

As shown in the graph above, the Bitcoin mining reserve has gone through a steady decline during this window. There have been some transition periods, but the overall trend has remained towards the downside.

Historically, the miners have had a presence as regular sellers on the network. The reason behind this is that these chain validators have constant running costs in the form of electricity bills, which they pay by selling their BTC rewards for fiat.

In general, however, despite being regular sellers, miners do not place too much risk on the price, as the sale tends to be at a level that the market can take. in easily. That said, the times in which they participate in large sales can be monitored.

At the beginning of this year, the Bitcoin miners held a total of 1.99 million BTC in their reserve. Today, the same metric is at 1.90 million BTC, meaning that the miners have sold 90,000 BTC (about $9.3 billion at the current exchange rate) or 4.74% of their holdings.

Related Reading

This is a significant amount on its own, but when considered in the context that this sale has occurred over time rather than within a narrow window, the sale ceases to be too interesting

“Miners are downloading regularly, but not in large amounts,” the analyst said. “This suggests that they are likely to be sold to cover operating costs. ” Therefore, it is possible that Bitcoin would not feel any negative impact from this miner sale.

The mining reserve could still be watched in the near future, however, because any sharp change in the metric could spell a new result for Bitcoin.

BTC price

Bitcoin set new high level ever passed the $106,000 mark earlier in the day, but the coin seems to have pulled back since then as it is now trading around $104,000.

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com