Reason for trust

A tight active policy that focuses on accuracy, reincity, and inatory

Created by business experts and carefully revised on

The highest standards in reporting and publishing

A tight active policy that focuses on accuracy, reincity, and inatory

The lion football price and soft players. Per An UCU LORM, the uniforms of the KUCOorm's football.

Over the last few weeks, it was unable to have the Bitcoin price to keep a meaningful movement on the journey to recover. After falling to just over $ 81,000 on Tuesday, March 18, patchy clans for the $ 87,000 signal.

Below why the $ 87,000 grade may be able to prove a pivotal to the long-term health to the bitcoin Price.

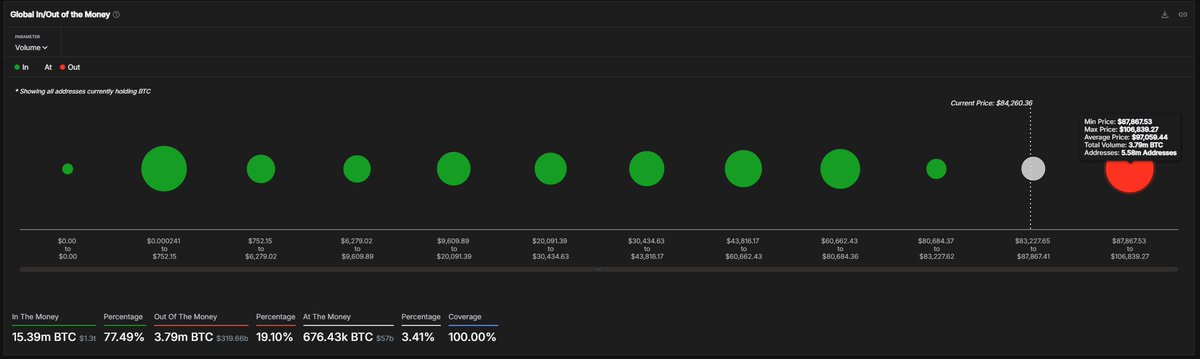

5.58 million BTC sailing 'sitched on hot potatoes'

In 21 March on stage x, Crypto Spypto is analysis of a maturan discussed the meaning of $ 87,000 as an important part of the route of the route bitcoin price in the future. The reasoning is behind this particular outlining this as the average cost of a number of btc investors.

Related reading

Investigation of cost include pricing grade capability Assessment to be applied to an action or support based on the total level of coins that have been purchased in or around it. As shown in the chart below, size of the dot appears the number of coins that have been purchased inside a particular price bracking. (So the strength of the support area or opposite).

According to a marton, about 5.78 Monial Addresses 3.79 million BTC ($ 367 billion value at average price of $ 97,867. 56,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,8 6,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86, 86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,8 6,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,86,839 Division. The investigator noted that the Investors here “sits on hot potatoes” and in the red, they all bought at a price above the current price.

Generally, the grade is usually $ 87,867,867,837,839, as they may sell their funds depending on the Bitcoin price Coverage of a charge. This sale operation would be slightly pressure down on the main CryptocRSy, block additional price motion throughout the other price.

In addition, Magarty signally identified the internal investment within the $ 87,867 – $ 106,839 as a summary keeper, a investor class. Therefore, the staff noted that it may not be a very exceptional situation, particularly if the market sees another wave of behavior weight.

Short-time keeper has been associated with Upper sales events (in responding to price changes). In the end, this means the Bitcoin Market could be greatly knowledge of a large Bitulation event if their short-term investigation event can be highly aware of the $ 87,839,839.

Bitcoin's price at the bat

For this writing, the price of the BTC is going round the $ 84,000 signal, showing any big changes in the past 24 hours.

Related reading

A special profile from Aircut, card from a trade

(TabstoTTranslate) Bitcoin

Source link